In a Word About Goals and Risk is unavoidable. Let's get to the good news, we established 2 cornerstone axioms:

Risk is personal

If you need ransom money by Friday betting your savings on a hand of blackjack or borrowing cash from a loan shark become prudent alternatives in light of your singular goal.

On the other hand, a comfortable person who risks what they need for something they merely want is setting themselves up for failure. Even if the gamble pays off, that decision pattern eventually catches up with them.

Doing the inner work to distinguish “need to haves” from “nice to haves” is a personal exercise. Looking over the fence at your neighbor leads to miswanting and disappointment. We cannot fully see what practical and mental constraints others have that lead to their choices. You must ruthlessly “do you”.

A bright side of personal investing is that it is solitaire. You do not need to worry about competitors the way professional investors do. Professionals are compared to benchmarks which introduces tracking error risks (”why are you only up 8% when the SP500 is up 11%?”) and path dependency. Employees are more likely to browse LinkedIn job boards when you don’t keep up, which aggravates your competitive position further.

The personal investor is unburdened by the expectations of others

Risk is unavoidable

Examples of this reality:

- If you don’t invest your cash its purchasing power will erode. In the past 100 years, cash has lost >95% of its value. Not investing is surrendering to an inevitable, maybe slow, but quite inevitable loss.

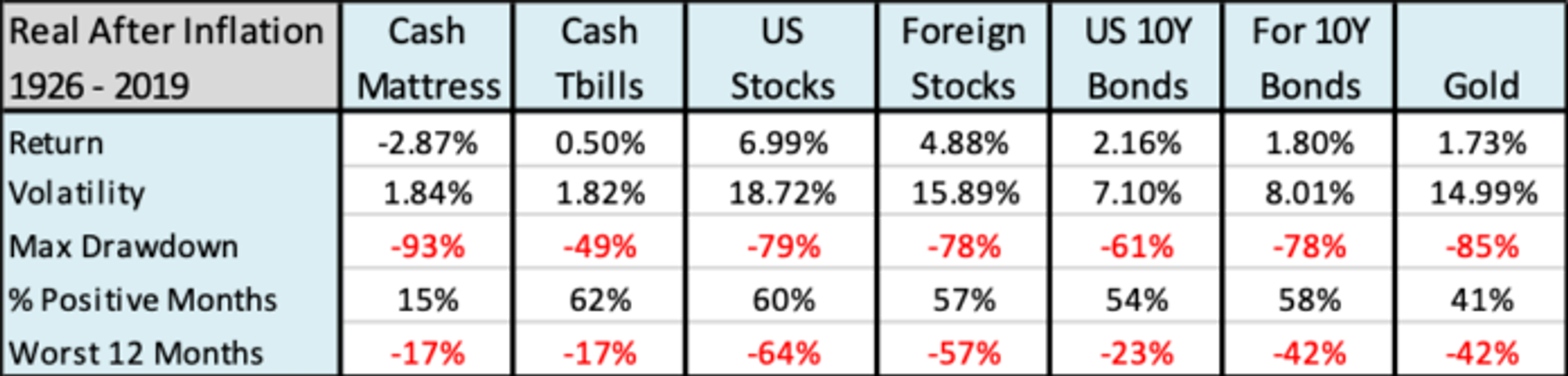

- If you do invest, you open yourself to the possibility of a faster loss. This is true in both nominal and real (ie adjusted for inflation) terms. In the 21st century alone we’ve seen sharp drawdowns from the Dot Com bubble, the 2008 GFC, and the covid pandemic in 2020. Drawdowns of these magnitudes, while rare, are inevitable and part of the investing experience. As Meb Faber shows, this is true even in real terms:

- The trade-off between “failing fast” and “failing slow” shifts as you age. If you lose 40% of your assets at age 24 you have your whole adult life to recover. If you’re in your 60s such a sharp loss could impair your standard of living throughout retirement. This is commonly referred to as sequence of return risk. It’s the basis of “glide paths” that slip your investment mix from higher to lower risk holdings as you age.

Wrapping Up With Helpful Framings

By now we have laid out the nature of markets as well as the investing “problem”. The strategy we employ needs to be well-matched to our risk tolerance. Investment returns are carrots for us to take risk and solve our “problem”. There is no way to fully remove risk from a strategy but we can imagine a frontier of strategies that require lesser units of risk for the same potential reward. For example, if a fair coin flip offered 2-1 odds then this is a great investment. But if you bet all your money on it you turn this great investment into one that is not worth the risk since losing all your money is not an acceptable outcome.

We want to avoid strategies that are inferior with respect to our goals

Our tolerance for risk is a personal function of our emotions and our stated goals. Financial advisors try to match their approach to a client’s risk appetite with questionnaires such as the Grable & Lytton Risk Assessment (link). A common though cynical take is such gauges are more about covering their liability than actually zeroing in on risk tolerance. A charitable view is that asking someone to predict how they’d feel if their account lost 25% is a doomed exercise from the start. We are not Vulcans capable of such reasoned foresight.

When it comes to goals, the problem is more tractable, especially for near-term objectives. If you are saving for a down payment on a house in the next few years, you can compare your savings rate to the fluctuations of your account to decide how much risk is reasonable. If you have $450k saved for a $500k down payment and you are able to save $25k per year, then if you took no risk you are about 2 years from affording a home. If you invest the $450k in BTC you could lose many years worth of savings in a single swoop. You should match your the riskiness of your investments to what you consider a “need to have” vs a “nice to have”. A common sense approach is a robust balance between being simple enough and effective enough.

When it comes to personal finance, optimization suffers from garbage-in, garbage-out problems. The idea is not to make perfect the enemy of the good. It’s to find an approach that mostly works that you can stick to. It is easy to get bogged down in FIRE-esque micro-budgeting or dazzled by promises of easy money in rental properties or option selling. But before you even consider an investing strategy, it’s critical to establish your goals for both your wealth and your time. If eeking out an extra 1% on a $500k portfolio takes 100 hours, you are working for $50/hr with no guarantee that you are focused on the right levers.

2 qualitative frameworks that can help define your investment mission:

- Jeff Bezos’ regret minimization framework Imagine you are old or at your funeral looking back in time. What did you want to give the world or your family? What would you regret not having done? The idea is simple — don’t take risks that close those doors. Structure your life so you can take the risks that open those doors. The key to this is defending your aspirations with a mix of personal courage plus resistance to distraction and comparison.

- Venkatesh Rao’s fixed point futurism This is the antidote to the inherent spreadsheet nihilism of efficiency, optimization, and “paper-clip maximization”. It is deeply personal.

Fixed-point futurism is related to the idea of inventing the future rather than predicting it…It’s simple: don’t make plans, choose fixed points. Choose one thing to make true, force to be true, about the future. Something that is likely to be within your control, no matter how the future plays out. Something that isn’t rationally derived from something else more basic, but is sort of arbitrary and self-defining. It sounds silly, but it’s really amazing how such small assertions of personal agency, far short of putting a “ dent in the universe ” can magically make life feel more meaningful. You’re arbitrarily using your life to declare that futures, where you wear blue shirts, are better than ones in which you don’t. Many people intuitively do fixed-point futurism. In fact, in the U.S ., the so-called American Dream has historically been based on the standard fixed point of homeownership. As in, “no matter what happens in the future, I’ll be a homeowner. ” A way to understand fixed-point futurism is to think of it as a priceless commitment. No matter what happens, and no matter what else goes wrong or off-the-rails in weird ways , you’ll make sure one thing goes really, really right, even if you have to go crazy making sure it does. The nice thing about fixed - point futurism is that you don’t have to worry about tradeoffs . You don’t have to constantly revisit cost - benefit analyses . You don’t have to worry about competing priorities . The fixed point is priceless , so you can commit to it without knowing lots of important things about the future.

This type of thinking says “I’m going to play in a band even if there’s no reward. I just want to do it”. It could mean taking an insurance policy knowing that no matter what your kids will have X even if it’s not as “smart” as self-insuring the future via a separately managed investment account.

A reckless person can use fixed-point thinking to rationalize poor decisions, but overly analytical people can benefit from pulling their noses out of Excel to think more approximately. The whole “it’s better to be roughly right, than precisely wrong” thing.

Learn More

- Newfound Research’s Failing Slow, Failing Fast, and Failing Very Fast (Link)

- Nick Maggiulli's A Change in Perspective (Link)

- Alpha Architect’s Even God Would Get Fired As An Active Manager (Link)

- Venkatesh Rao on Fixed Point Futurism (Link)