A Famous Riddle

The lily pad doubles in size every day and after 365 days it completely covers the pond. On what day does the lily pad cover half the pond?

Answer

On the 364th day

Compound Growth

Our minds struggle with geometric growth (ie x) and exponential growth (ie 2). We extrapolate and interpolate linearly but the key observation is that these processes are multiplicative, not additive.

This is the same process that governs compounding investment returns. When you invest, it’s typical that you stay invested or re-invest. If you start with $100,000 and earn 10%, you now have $110,000 to reinvest.

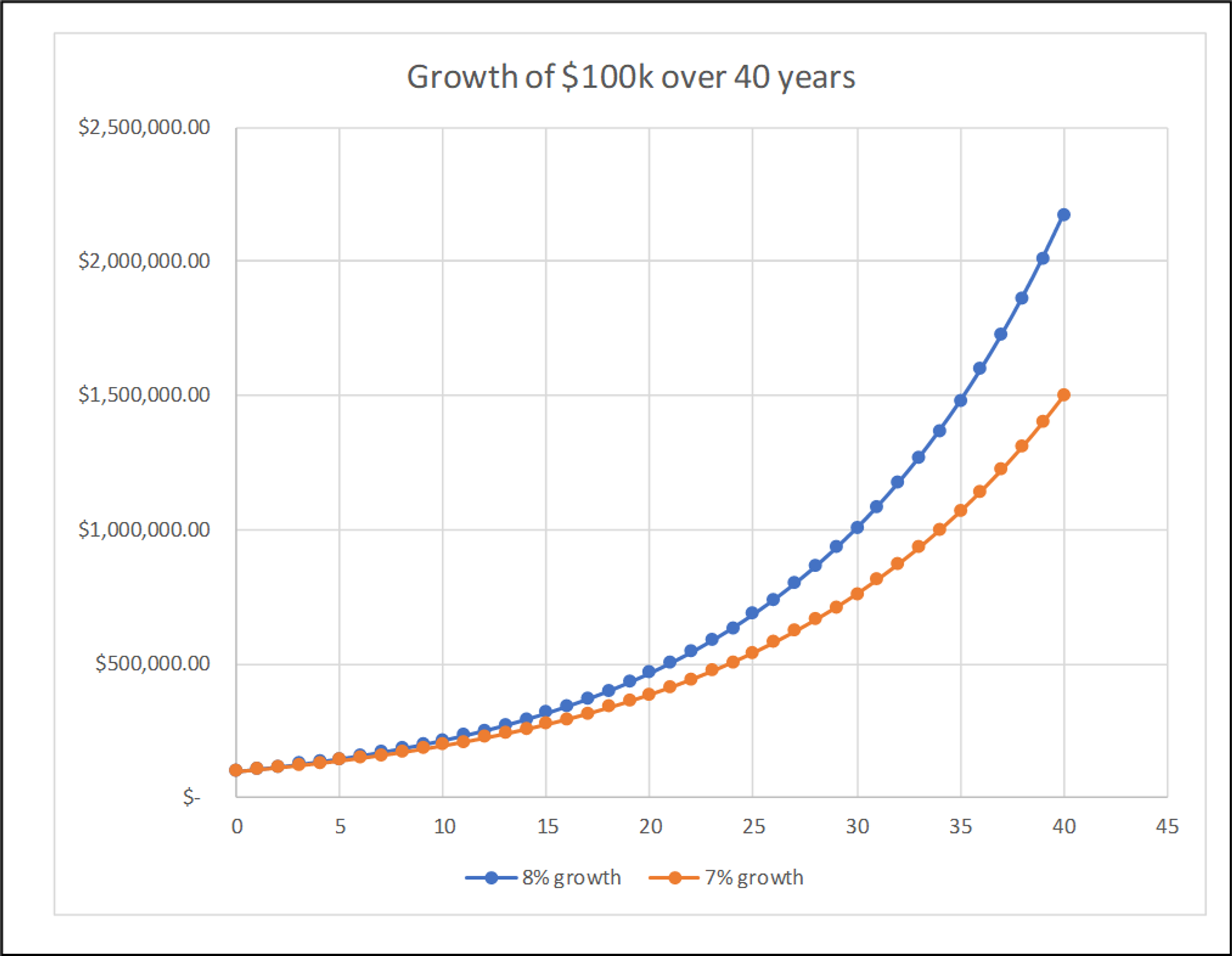

The tricky bit about compounding is appreciating how small changes in the rate of growth have a disproportionate impact on final wealth.

If you start investing at age 30 with $100k, and compound growth at 8% per year instead of 7%, you will have 45% more wealth by age 70.

This is a cold splash of water when you consider how many forces conspire to knock at least 1-2% off your investment returns:

- Financial advisory AUM fees

- Mutual fund expense ratios

- The difference between ordinary income taxes and long-term capital gains

- State income taxes

- Property taxes that revalue higher as your home appreciates

- Inflation

Another significant observation is how compounding’s best friend is uninterrupted time. If we doubled the rates of return in the chart to Hall of Fame return levels of 16% and 14% CAGRs but cut the compounding time in half to 20 years, you end up a bit worse off than in the 40-year case.

Teach your kids about compounding early!

“Compound interest is the eighth wonder of the world. He who understands it, earns it … he who doesn’t … pays it.” — Albert Einstein

The power of time

While Warren Buffet has been an above-average investor over his entire career his status as one of the richest people in the world owes much to longevity. [He was stellar for several decades but as you might expect by the time he was managing tens of billions, the performance asymptotically reverted to just market-like returns.]

He didn’t become a billionaire until he was about 60. He has since been compounding for 30+ years! Most people don’t even make it into their 90s let alone can say they’ve been investing since they were teens.

The Compounding “Gotcha”

If you earn a 10% return, then lose 10% your average return is 0…but your realized return is -1%

$100 —> $110 —> $99

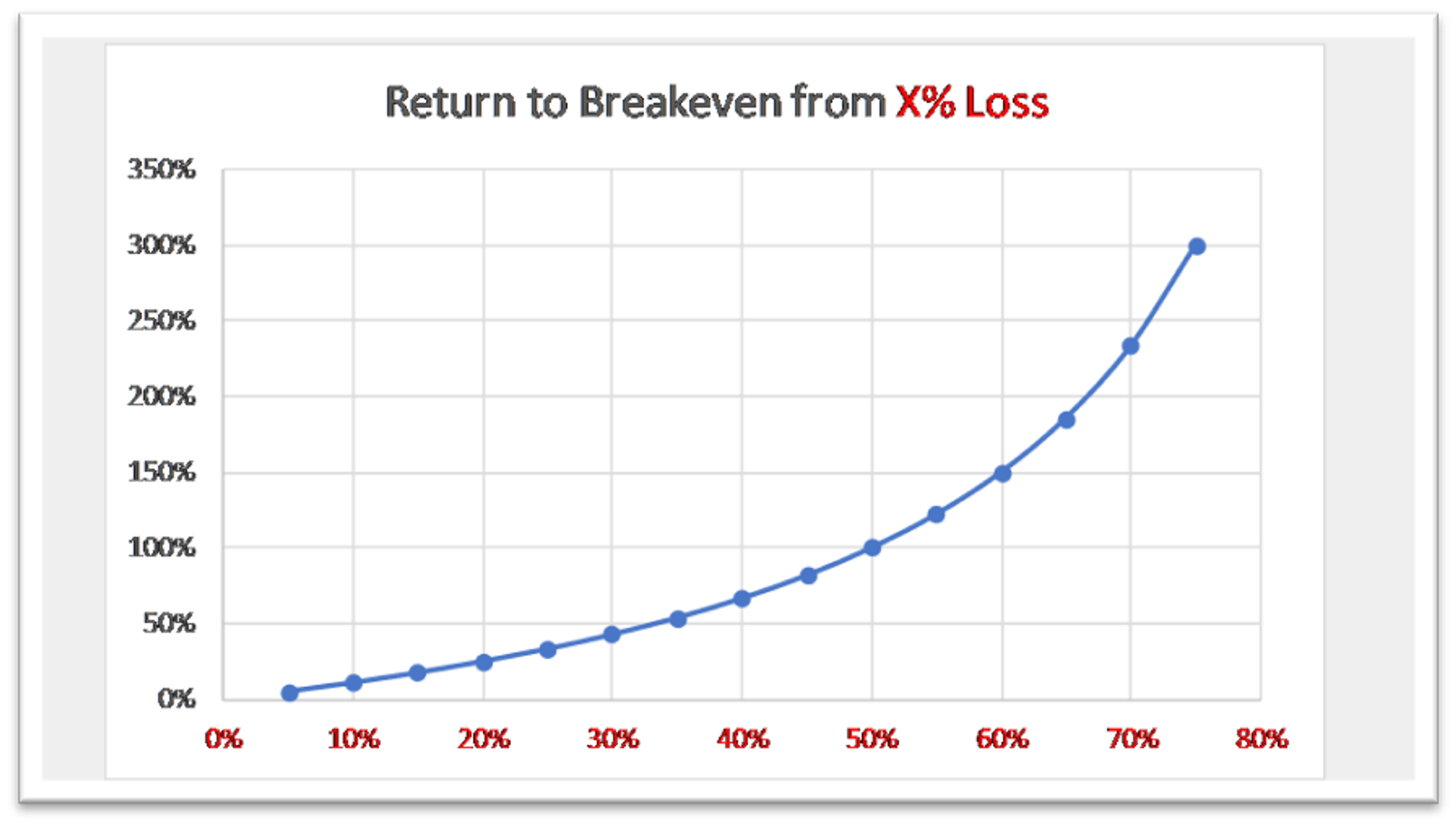

If you lose 50%, you need to make 100% to get back to even.

More generally:

If you lose %, you must earn % to return your money.

2 key things to note:

- Return math is asymmetric — the return required to recover is larger than the percentage loss

- This asymmetry gets worse with volatility. The larger the loss, the steeper the recovery function. If you lose 75% on an investment you need to triple your money to get back to even!

This property of compounding math is so fundamental to investing that it underpins everything from risk management to option pricing. If you are interested in learning more there are several useful links below but the main takeaways:

- Investing is a multiplicative process so we want to look at compounded returns not simple returns

- Volatility is asymmetric — over time it pulls median returns (the returns you expect to see) lower than average returns.

- Volatility has a non-linear relationship with expected returns — while you need some volatility (if there were no volatility you would not get anything more than a risk-free rate), some drawdowns are too steep to recover from.

Learn More

I’ve written a lot on this topic.

Moontower

From Around the Web

- You Are Not a Monte-Carlo Simulation (Newfound Research)

- Money Weighted vs Time Weighted Returns (Investopedia)